Mixed-Matrix Membrane (MxM) Gas Separation Technologies in 2025: Unleashing Next-Gen Efficiency and Market Expansion. Explore How MxM Innovations Are Redefining Gas Separation for a Sustainable Future.

- Executive Summary: Key Findings and 2025 Outlook

- Market Size, Growth Rate, and Forecasts (2025–2030)

- Technology Landscape: MxM Materials, Designs, and Performance

- Competitive Analysis: Leading Companies and Strategic Initiatives

- Application Segments: Energy, Chemicals, Environmental, and More

- Drivers and Challenges: Regulatory, Economic, and Technical Factors

- Recent Innovations and R&D Pipeline (Citing Company Sources)

- Regional Analysis: North America, Europe, Asia-Pacific, and ROW

- Sustainability and Decarbonization Impact of MxM Technologies

- Future Outlook: Opportunities, Risks, and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

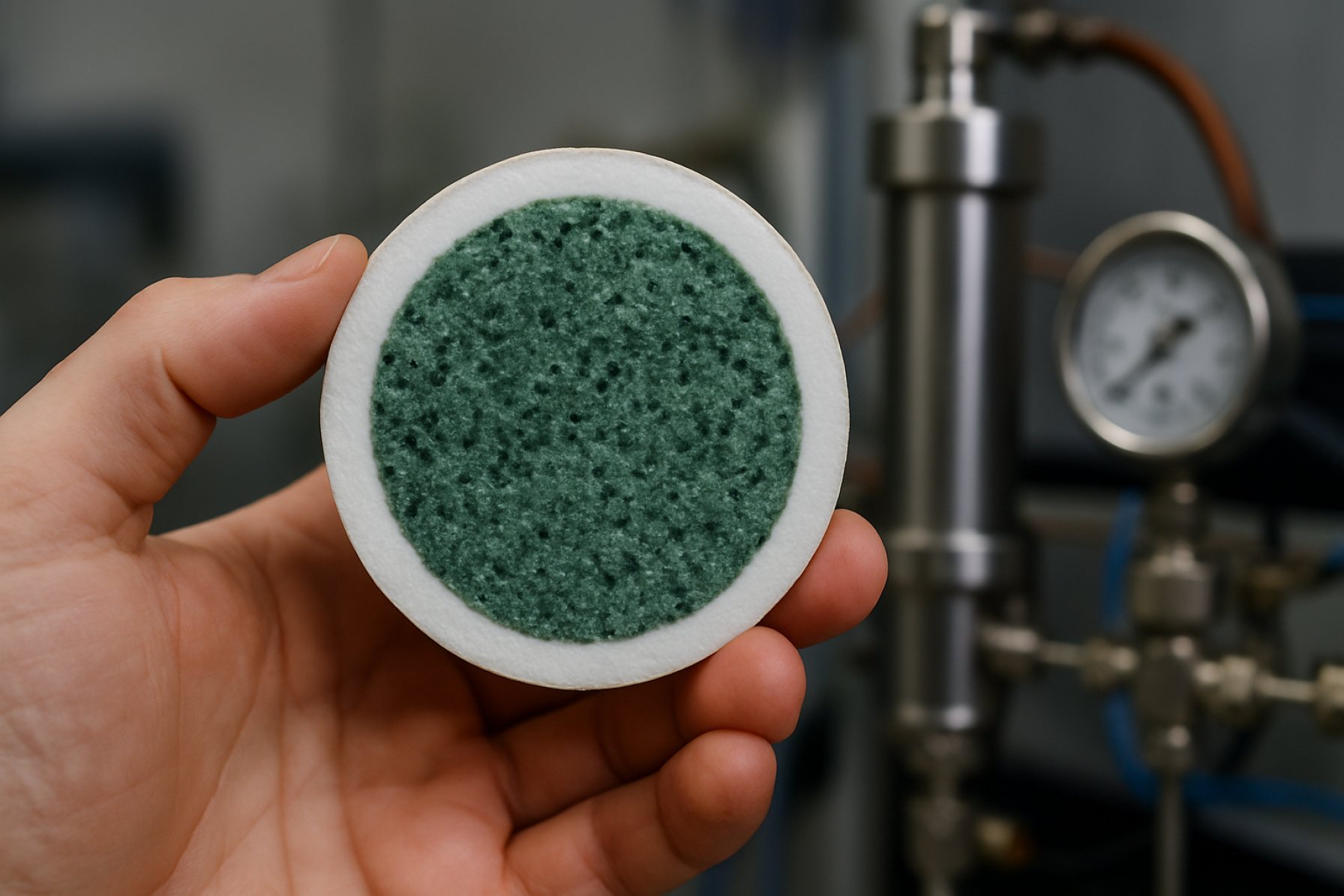

Mixed-Matrix Membrane (MxM) gas separation technologies are poised for significant advancements and commercial traction in 2025, driven by the urgent need for energy-efficient and cost-effective gas separation solutions across industries such as natural gas processing, hydrogen production, carbon capture, and air separation. MxMs, which combine the processability of polymers with the selectivity and permeability of inorganic fillers (such as zeolites, metal-organic frameworks, or carbon molecular sieves), are increasingly recognized as a next-generation solution to overcome the limitations of conventional polymeric and inorganic membranes.

In 2025, the global market is witnessing a transition from laboratory-scale demonstrations to pilot and early commercial deployments. Key industry players are scaling up MxM production and integrating these membranes into modular gas separation units. For example, Air Liquide—a global leader in industrial gases—has invested in advanced membrane R&D and is actively exploring MxM integration for CO2 capture and hydrogen purification. Similarly, Linde is developing hybrid membrane systems, leveraging MxM technology to enhance selectivity and reduce energy consumption in gas processing plants.

Recent pilot projects have demonstrated that MxM membranes can achieve CO2/CH4 selectivities exceeding 40 and CO2 permeances above 1,000 GPU, surpassing the performance of traditional polymeric membranes. These improvements are particularly relevant for biogas upgrading and natural gas sweetening, where operational efficiency and cost reduction are critical. Companies such as Honeywell UOP and Evonik Industries are actively developing and testing MxM modules for these applications, with field trials expected to expand in 2025.

The 2025 outlook is shaped by several factors:

- Continued R&D investment by major industrial gas suppliers and specialty chemical companies to optimize MxM formulations and scale up manufacturing.

- Growing regulatory and market pressure to decarbonize industrial processes, driving demand for efficient CO2 capture and hydrogen purification technologies.

- Emergence of strategic partnerships between membrane developers, engineering firms, and end-users to accelerate commercialization and deployment.

- Ongoing technical challenges, including long-term membrane stability, fouling resistance, and cost-effective module fabrication, which remain focal points for innovation.

In summary, 2025 marks a pivotal year for MxM gas separation technologies, with leading companies such as Air Liquide, Linde, Honeywell UOP, and Evonik Industries driving the transition from advanced prototypes to early commercial adoption. The sector is expected to see accelerated growth and broader application, particularly in decarbonization and clean energy value chains.

Market Size, Growth Rate, and Forecasts (2025–2030)

The global market for Mixed-Matrix Membrane (MxM) gas separation technologies is poised for significant expansion between 2025 and 2030, driven by increasing demand for energy-efficient gas separation solutions in sectors such as natural gas processing, hydrogen production, carbon capture, and industrial gas purification. MxM membranes, which combine the processability of polymers with the selectivity of inorganic fillers, are gaining traction as a next-generation alternative to conventional polymeric and inorganic membranes.

As of 2025, the adoption of MxM technologies is accelerating, particularly in regions with stringent environmental regulations and ambitious decarbonization targets. The Asia-Pacific region, led by China, Japan, and South Korea, is emerging as a key growth hub due to rapid industrialization and investments in clean energy infrastructure. North America and Europe are also witnessing increased deployment, supported by government incentives for carbon capture and utilization (CCU) and hydrogen economy initiatives.

Major industry players such as Air Liquide, Linde, and Air Products and Chemicals are actively investing in the development and commercialization of advanced MxM modules for applications including CO2 removal from natural gas, biogas upgrading, and hydrogen purification. These companies are leveraging their global presence and R&D capabilities to scale up pilot projects and transition to full-scale commercial operations. For example, Air Liquide has announced ongoing efforts to integrate novel membrane materials into its gas separation portfolio, targeting improved selectivity and durability for industrial clients.

The market is expected to register a compound annual growth rate (CAGR) in the high single digits to low double digits through 2030, with total market value projected to reach several hundred million USD by the end of the forecast period. Growth is underpinned by the increasing need for cost-effective and modular gas separation solutions, as well as the scalability of MxM technologies for both large-scale and decentralized applications.

Looking ahead, the next few years will likely see further collaboration between membrane manufacturers, material science innovators, and end-users to optimize MxM performance and reduce production costs. Companies such as Evonik Industries and Honeywell UOP are also expected to play a pivotal role, given their expertise in specialty polymers and process engineering. The outlook for 2025–2030 is characterized by robust R&D activity, increasing pilot deployments, and a gradual shift toward commercial-scale adoption, particularly in sectors aligned with global decarbonization and energy transition goals.

Technology Landscape: MxM Materials, Designs, and Performance

Mixed-matrix membrane (MxM) gas separation technologies are at the forefront of advanced separation processes, combining the processability of polymers with the selectivity and permeability enhancements offered by inorganic fillers. As of 2025, the technology landscape is characterized by rapid material innovation, scale-up efforts, and increasing commercial interest, particularly for applications in carbon capture, hydrogen purification, and natural gas upgrading.

The core of MxM technology lies in embedding inorganic or hybrid fillers—such as zeolites, metal-organic frameworks (MOFs), carbon molecular sieves, or graphene derivatives—into polymer matrices. This approach aims to overcome the permeability-selectivity trade-off inherent in conventional polymeric membranes. Recent years have seen a surge in the development of new filler materials, with MOFs and advanced porous carbons gaining particular attention for their tunable pore structures and high surface areas. Companies like Air Products and Chemicals, Inc. and Linde plc are actively exploring these materials for next-generation membrane modules, targeting industrial-scale gas separations.

Design innovations are also shaping the MxM landscape. Hollow fiber and flat-sheet module configurations remain dominant, but there is a growing trend toward modular, scalable systems that can be retrofitted into existing gas processing infrastructure. Air Liquide and Honeywell UOP are notable for their efforts in integrating MxM modules into pilot and demonstration plants, particularly for CO2 removal from flue gases and biogas upgrading.

Performance metrics for MxM membranes have improved significantly, with laboratory-scale demonstrations routinely achieving CO2/CH4 and H2/CO2 selectivities exceeding those of traditional polymeric membranes. For example, selectivities above 60 for CO2/CH4 and permeabilities in the range of 1000–3000 Barrer are now reported for advanced MxM systems. However, translating these gains to commercial-scale, defect-free modules remains a challenge, with issues such as filler-polymer compatibility, long-term stability, and cost-effective manufacturing under active investigation.

Looking ahead to the next few years, the outlook for MxM gas separation technologies is promising. Major industrial players are expected to move from pilot to early commercial deployments, especially in regions with strong policy drivers for decarbonization and hydrogen economy development. Partnerships between membrane manufacturers, chemical companies, and end-users are likely to accelerate technology validation and market entry. As the sector matures, standardization of performance testing and module integration will be critical, with organizations such as The Chemours Company and BASF SE poised to play influential roles in shaping the commercial landscape.

Competitive Analysis: Leading Companies and Strategic Initiatives

The competitive landscape for Mixed-Matrix Membrane (MxM) gas separation technologies in 2025 is characterized by a blend of established membrane manufacturers, chemical companies, and innovative startups, all vying to commercialize advanced solutions for industrial gas separations. The sector is driven by the need for higher selectivity, permeability, and operational stability in applications such as carbon capture, hydrogen purification, and natural gas processing.

Among the global leaders, Air Liquide continues to invest in membrane-based gas separation, leveraging its extensive experience in industrial gases and advanced materials. The company’s R&D efforts focus on integrating inorganic fillers into polymer matrices to enhance CO2 capture efficiency and durability, with pilot projects underway in Europe and Asia. Similarly, Linde is advancing its membrane portfolio, targeting both hydrogen recovery and biogas upgrading, and has announced collaborations with academic partners to accelerate the scale-up of MxM modules.

In the United States, Air Products and Chemicals, Inc. is a prominent player, with a strong track record in membrane technology for hydrogen and nitrogen production. The company is actively developing next-generation MxM membranes, aiming to address the limitations of traditional polymeric membranes in aggressive industrial environments. Their strategic initiatives include partnerships with material science firms to co-develop novel filler materials and optimize membrane fabrication processes.

On the materials front, BASF is leveraging its expertise in polymers and adsorbents to create hybrid MxM solutions tailored for CO2 removal and natural gas sweetening. BASF’s approach emphasizes the scalability of membrane production and integration with existing gas processing infrastructure, positioning the company as a key supplier to both energy and chemical sectors.

Emerging companies and university spin-offs are also making significant strides. For example, Evonik Industries has commercialized high-performance membrane modules based on its SEPURAN® platform, and is actively exploring MxM enhancements to further boost selectivity and throughput. Meanwhile, Honeywell UOP is piloting MxM-based systems for refinery off-gas treatment and carbon capture, with a focus on modular, retrofittable units.

Looking ahead, the competitive dynamics are expected to intensify as regulatory pressures on emissions and energy efficiency mount. Strategic initiatives such as joint ventures, licensing agreements, and government-funded demonstration projects are likely to proliferate, with leading companies seeking to secure intellectual property and first-mover advantages in the rapidly evolving MxM gas separation market.

Application Segments: Energy, Chemicals, Environmental, and More

Mixed-Matrix Membrane (MxM) gas separation technologies are rapidly advancing across multiple application segments, notably in energy, chemicals, and environmental sectors. As of 2025, the drive for decarbonization, process intensification, and cost-effective gas purification is accelerating the adoption of MxM solutions, which combine the processability of polymers with the selectivity and permeability of inorganic fillers.

In the energy sector, MxM membranes are increasingly deployed for natural gas sweetening, hydrogen recovery, and biogas upgrading. The global push for cleaner fuels and hydrogen economy initiatives is spurring investments in advanced membrane modules. Companies such as Air Liquide and Linde are actively developing and commercializing membrane-based gas separation systems, with ongoing research into MxM enhancements to improve CO2/CH4 and H2/CO2 selectivity. These improvements are critical for meeting stringent pipeline and fuel standards, as well as for reducing the energy intensity of traditional amine-based processes.

Within the chemical industry, MxM membranes are being integrated into processes for olefin/paraffin separation, ammonia synthesis gas purification, and carbon capture from flue gases. The ability of MxMs to tailor separation performance by adjusting filler type and loading is particularly valuable for challenging separations. UOP (A Honeywell Company) and Evonik Industries are among the key players advancing membrane modules for petrochemical and specialty gas applications, with pilot and demonstration projects underway to validate long-term stability and scalability.

In the environmental segment, MxM technologies are gaining traction for post-combustion CO2 capture, landfill gas upgrading, and air pollution control. The modularity and lower footprint of membrane systems make them attractive for retrofitting existing plants and distributed emission sources. Membrane Solutions and GENERON are commercializing advanced membrane skids, with ongoing R&D to incorporate MxM materials for higher selectivity and fouling resistance.

Looking ahead to the next few years, the outlook for MxM gas separation is robust. Industry collaborations, government funding, and regulatory drivers are expected to accelerate commercialization, especially as pilot projects transition to full-scale deployment. The versatility of MxM membranes positions them for expansion into emerging areas such as carbon-negative technologies, green hydrogen production, and resource recovery from waste streams. As material science and process engineering converge, MxM gas separation is poised to play a pivotal role in the global transition toward cleaner, more efficient industrial operations.

Drivers and Challenges: Regulatory, Economic, and Technical Factors

Mixed-Matrix Membrane (MxM) gas separation technologies are gaining momentum in 2025, driven by a confluence of regulatory, economic, and technical factors. The global push for decarbonization and stricter emissions standards is a primary regulatory driver. Governments in North America, Europe, and parts of Asia are tightening regulations on industrial greenhouse gas emissions, particularly for sectors such as natural gas processing, hydrogen production, and carbon capture. For example, the European Union’s Green Deal and the U.S. Inflation Reduction Act are incentivizing the adoption of advanced separation technologies, including MxM membranes, to meet ambitious CO2 reduction targets.

Economically, the demand for cost-effective and energy-efficient gas separation solutions is intensifying. Traditional separation methods like cryogenic distillation and pressure swing adsorption are energy-intensive and costly, especially for large-scale applications. MxM membranes, which combine the processability of polymers with the selectivity of inorganic fillers, offer the potential for lower operational costs and reduced energy consumption. This is particularly relevant for the rapidly expanding hydrogen economy, where high-purity hydrogen is required for fuel cells and industrial processes. Companies such as Air Liquide and Linde are actively developing and piloting membrane-based gas separation systems, including MxM variants, to address these market needs.

On the technical front, significant progress has been made in overcoming historical challenges associated with MxM membranes, such as interfacial compatibility between polymer matrices and inorganic fillers, as well as long-term stability under industrial conditions. Recent advances in nanomaterial engineering and surface functionalization have enabled the production of membranes with enhanced selectivity and permeability, making them increasingly viable for commercial deployment. Leading membrane manufacturers like Evonik Industries and UOP (a Honeywell company) are investing in R&D to optimize MxM formulations for specific gas separations, including CO2/CH4 and H2/CO2 separations.

Despite these advances, challenges remain. Scaling up production while maintaining membrane performance and consistency is a key hurdle. Additionally, the long-term durability of MxM membranes in harsh industrial environments is still under evaluation. The need for standardized testing protocols and regulatory acceptance also poses barriers to widespread adoption. However, with ongoing collaboration between industry leaders, research institutions, and regulatory bodies, the outlook for MxM gas separation technologies in the next few years is optimistic, with pilot projects expected to transition into full-scale commercial operations by the late 2020s.

Recent Innovations and R&D Pipeline (Citing Company Sources)

Mixed-matrix membrane (MxM) gas separation technologies are experiencing a surge in innovation, with 2025 marking a pivotal year for both academic and industrial R&D. MxMs, which combine polymer matrices with inorganic or organic fillers, are being developed to overcome the permeability-selectivity trade-off that limits conventional polymeric membranes. Recent advances focus on optimizing filler dispersion, interfacial compatibility, and scalable fabrication methods to enable commercial deployment in sectors such as natural gas processing, hydrogen purification, and carbon capture.

A leading player in the field, Air Liquide, has reported ongoing R&D into hybrid membrane materials for CO2 removal and hydrogen recovery. Their recent disclosures highlight the integration of advanced zeolitic and metal-organic framework (MOF) fillers into robust polymer backbones, targeting improved selectivity and operational stability under industrial conditions. Similarly, Linde is actively developing next-generation membranes, with a focus on MxMs for biogas upgrading and syngas purification, leveraging their expertise in large-scale gas processing and membrane module engineering.

In Asia, Toray Industries continues to invest in MxM research, particularly for hydrogen separation and CO2 capture. Their pipeline includes the use of carbon molecular sieve and silica-based fillers, with pilot-scale demonstrations underway as of 2025. Mitsubishi Chemical Group is also advancing MxM technology, focusing on the integration of functionalized nanoparticles to enhance gas selectivity and anti-fouling properties, with applications in ammonia and hydrogen value chains.

Startups and university spin-offs are contributing to the innovation landscape. For example, Evonik Industries has expanded its membrane portfolio to include MxMs for natural gas sweetening and hydrogen purification, with recent patents covering novel MOF-polymer composites. Their collaboration with academic partners aims to accelerate the scale-up of these materials for commercial module production.

Looking ahead, the R&D pipeline is expected to deliver MxM membranes with higher flux, improved selectivity, and longer operational lifetimes. Industry forecasts suggest that by 2027, several of these innovations will transition from pilot to full-scale deployment, particularly in hydrogen and CO2 separation markets. The ongoing collaboration between membrane manufacturers, chemical companies, and end-users is likely to drive further breakthroughs, positioning MxM technologies as a cornerstone of next-generation gas separation solutions.

Regional Analysis: North America, Europe, Asia-Pacific, and ROW

The global landscape for Mixed-Matrix Membrane (MxM) gas separation technologies is evolving rapidly, with significant regional differences in adoption, research intensity, and commercialization. As of 2025, North America, Europe, and Asia-Pacific are the primary hubs for innovation and deployment, while the Rest of the World (ROW) is gradually increasing its participation, particularly in response to energy transition and decarbonization imperatives.

- North America: The United States remains a leader in MxM gas separation technology, driven by robust R&D ecosystems and strong industrial demand for carbon capture, hydrogen purification, and natural gas processing. Companies such as Air Products and Chemicals, Inc. and Honeywell UOP are actively developing and piloting advanced MxM modules, often in collaboration with national laboratories and universities. The U.S. Department of Energy continues to fund demonstration projects targeting CO2 capture from power plants and industrial sources, with several field trials expected to reach commercial scale by 2026. Canada is also investing in MxM research, particularly for hydrogen and biogas upgrading, supported by government initiatives and partnerships with technology providers.

- Europe: The European Union’s Green Deal and Fit for 55 package are accelerating the adoption of low-carbon technologies, including MxM membranes for gas separation. Leading European firms such as Evonik Industries AG and Air Liquide are scaling up production of MxM-based modules for CO2 removal, biogas upgrading, and hydrogen recovery. The region benefits from a strong regulatory push for carbon neutrality, with pilot projects underway in Germany, France, and the Netherlands. The European Membrane Society and various Horizon Europe-funded consortia are fostering cross-border collaboration, aiming to bring next-generation MxM membranes to market within the next few years.

- Asia-Pacific: Rapid industrialization and urbanization are driving demand for efficient gas separation in China, Japan, South Korea, and India. Chinese companies, including China Petrochemical Corporation (Sinopec), are investing in MxM technology for natural gas sweetening and hydrogen purification, often in partnership with academic institutions. Japan and South Korea are focusing on hydrogen economy initiatives, with companies like Toray Industries, Inc. developing advanced MxM membranes for fuel cell and clean energy applications. Regional governments are supporting pilot deployments, and several commercial-scale projects are anticipated by 2027.

- Rest of the World (ROW): While adoption is slower in Latin America, the Middle East, and Africa, interest in MxM gas separation is rising, particularly for natural gas processing and flue gas treatment. National oil companies and utilities are beginning to explore partnerships with global technology providers to localize membrane manufacturing and deployment. The pace of adoption is expected to accelerate as regulatory frameworks for emissions reduction mature and as the cost of MxM modules declines.

Overall, the next few years will see intensified regional competition and collaboration, with North America and Europe leading in innovation and early deployment, Asia-Pacific rapidly scaling up, and ROW markets poised for gradual but steady growth as technology costs decrease and policy support strengthens.

Sustainability and Decarbonization Impact of MxM Technologies

Mixed-Matrix Membrane (MxM) gas separation technologies are increasingly recognized for their potential to advance sustainability and decarbonization objectives in industrial gas processing, particularly as the world intensifies efforts to meet 2030 and 2050 climate targets. MxM membranes, which combine polymers with inorganic or organic fillers, offer enhanced selectivity and permeability compared to conventional polymeric membranes, making them attractive for applications such as carbon capture, hydrogen purification, and biogas upgrading.

In 2025, the deployment of MxM technologies is expected to accelerate, driven by regulatory pressures and corporate net-zero commitments. The ability of MxM membranes to efficiently separate CO2 from flue gases and natural gas streams is particularly relevant for decarbonizing hard-to-abate sectors like cement, steel, and chemicals. For example, Air Liquide—a global leader in industrial gases—has been actively developing advanced membrane solutions for CO2 capture and hydrogen production, with pilot projects demonstrating significant reductions in energy consumption and greenhouse gas emissions compared to traditional amine scrubbing.

Similarly, Linde is investing in membrane-based gas separation systems, including MxM variants, to support low-carbon hydrogen and clean energy initiatives. Their focus includes integrating membrane modules into existing gas processing infrastructure, which can lower the carbon intensity of hydrogen and ammonia production. These efforts align with the broader industry trend of leveraging modular, scalable technologies to retrofit legacy assets for improved environmental performance.

The sustainability impact of MxM membranes extends to biogas upgrading, where companies like Evonik Industries are commercializing membrane products that enable efficient removal of CO2 and other impurities from biogas, facilitating its use as renewable natural gas. Evonik’s SEPURAN® line, for instance, is being adapted with mixed-matrix enhancements to further boost selectivity and throughput, supporting the circular economy and reducing methane emissions from waste streams.

Looking ahead, the next few years are expected to see increased collaboration between membrane manufacturers, energy companies, and industrial end-users to scale up MxM deployment. The integration of MxM technologies with carbon capture and utilization (CCU) and hydrogen value chains is anticipated to play a pivotal role in achieving deep decarbonization. As regulatory frameworks tighten and carbon pricing mechanisms expand, the cost-effectiveness and environmental benefits of MxM membranes are likely to drive broader adoption, positioning them as a cornerstone of sustainable gas processing in the mid-2020s and beyond.

Future Outlook: Opportunities, Risks, and Strategic Recommendations

Mixed-Matrix Membrane (MxM) gas separation technologies are poised for significant advancements and market expansion in 2025 and the following years, driven by the urgent need for efficient, cost-effective, and sustainable gas separation solutions across industries such as energy, chemicals, and environmental management. The integration of inorganic fillers—such as zeolites, metal-organic frameworks (MOFs), and carbon-based nanomaterials—into polymer matrices continues to enhance membrane selectivity, permeability, and long-term stability, addressing key limitations of conventional polymeric membranes.

Opportunities in the near term are closely tied to the decarbonization of industrial processes and the global push for carbon capture, utilization, and storage (CCUS). MxM membranes are increasingly recognized for their potential in post-combustion CO2 capture, natural gas sweetening, and hydrogen purification. Major chemical and energy companies, including Air Liquide and Linde, are actively investing in advanced membrane technologies, with pilot and demonstration projects underway to validate MxM performance at scale. For example, Air Products has highlighted the role of hybrid and composite membranes in its gas processing portfolio, aiming to improve process efficiency and reduce operational costs.

The next few years will likely see increased collaboration between membrane manufacturers, material suppliers, and end-users to accelerate commercialization. Companies such as Evonik Industries and UOP (a Honeywell company) are developing proprietary MxM formulations and modular membrane systems tailored for specific gas separations, including biogas upgrading and hydrogen recovery. These efforts are supported by industry bodies like the American Chemistry Council, which advocates for innovation in sustainable chemical processing.

However, several risks remain. The scalability of MxM production, long-term membrane durability under harsh industrial conditions, and the integration of new materials into existing infrastructure present technical and economic challenges. Intellectual property concerns and the need for standardized testing protocols may also slow widespread adoption. Furthermore, competition from alternative separation technologies—such as cryogenic distillation and pressure swing adsorption—remains strong, particularly in established markets.

Strategic recommendations for stakeholders include prioritizing R&D investment in robust, scalable MxM fabrication methods, fostering public-private partnerships to de-risk pilot projects, and engaging with regulatory agencies to establish clear performance benchmarks. Early engagement with downstream users will be critical to ensure that MxM solutions align with operational requirements and sustainability goals. As the regulatory and market landscape evolves, companies that can demonstrate reliable, cost-effective, and environmentally friendly MxM gas separation solutions will be well-positioned to capture emerging opportunities in the global energy transition.

Sources & References

- Air Liquide

- Linde

- Honeywell UOP

- Evonik Industries

- BASF SE

- Membrane Solutions

- Mitsubishi Chemical Group

- American Chemistry Council